“Tax Freedom Day® 2012 arrives on April 17 this year, four days later than last year due to higher federal income and corporate tax collections. That means Americans will work 107 days into the year, from January 1 to April 17, to earn enough money to pay this year’s combined 29.2% federal, state, and local tax bill,” according to The Tax Foundation.

“If the federal government raised taxes enough to close the budget deficit—an additional $1.014 trillion—Tax Freedom Day would come on May 14 instead of April 17. That’s an additional 27 days of government spending paid for by borrowing. This year’s federal budget deficit remains high, though it has declined slightly over the past two years.”

“As the economic recovery continues, the growth in individual incomes and corporate profits will increase tax revenues and push Tax Freedom Day ever later in the year. The latest ever Tax Freedom Day was May 1, 2000—meaning Americans paid 33.0% of their total income in taxes. A century earlier, in 1900, Americans paid only 5.9% of their income in taxes, meaning Tax Freedom Day came on January 22.”

The above figures are the national average. Tax Freedom Day arrives on different dates for each state. Tax Freedom Day came April 12 for Ohio taxpayers. Tennessee enjoyed the earliest day, which was on March 31st but Connecticut will still be paying Uncle Sam until the 1st of May.

Last year, IRS processed 143 million tax returns, but only 58 million (59%) paid any taxes. They paid a total of $945 billion in federal income taxes. All of the tax filing consumes an estimated 7 billion hours in order to comply with the 3.8 million word tax code. This alone demonstrates the need for serious tax reform some similar to the simplified fair tax proposal.

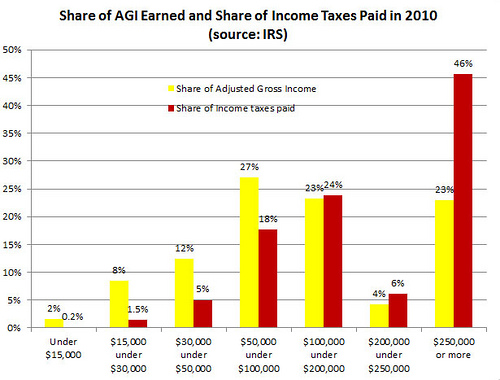

Below is a chart indicating the share of income taxes paid by adjusted gross income levels. As you will see, the Tax Foundation’s chart shows upper income earners already paying most of the federal income taxes. The Obamaites appear to wrong about the wealthy taxpayers not paying enough taxes.